Treasury software:

visualize your treasury forecasts and anticipate your needs

Treasury is the amount of money you have at your disposal at any given time, while the accounting result is the loss or surplus at the end of the year. A company with a profitable accounting can be endangered by a defective management of its treasury, related for example to excessive stocks or delays in customer payments. A treasury software allows you to follow your financial and accounting situation in real time.

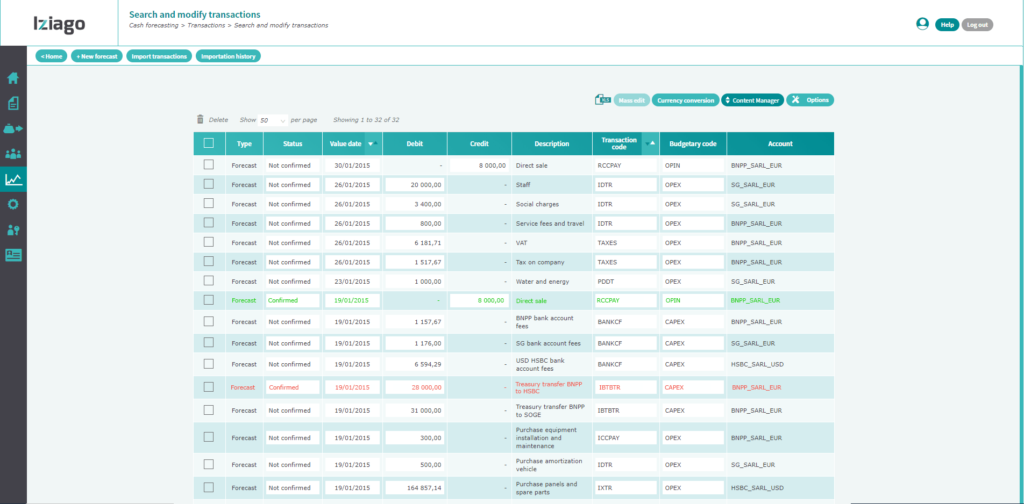

Save your future expenses/income

Create your forecasts in only a few clicks

The Cash forecasting solution allows you to enter unit forecasts (for a one-off expense) or recurring expenses (for rent, salary payments, sales, invoices, etc.). Since the module is preconfigured with budgetary codes and transaction codes, you can categorize your forecasts with a single click.

For your recurring forecasts, you can define an amount development rule as a value or a percentage or define your own timeline by entering amounts or a total amount to be broken down. For example, if you expect your sales to grow, you can increase the amount of the sales forecast each month by applying a percentage growth. You can easily find your recurring forecasts by color-coding them.

You can also import your forecasts into our tool from an Excel file or a separated text file.

- Thanks to the module’s advanced features, you save time entering forecasts and you have qualified forecasts.

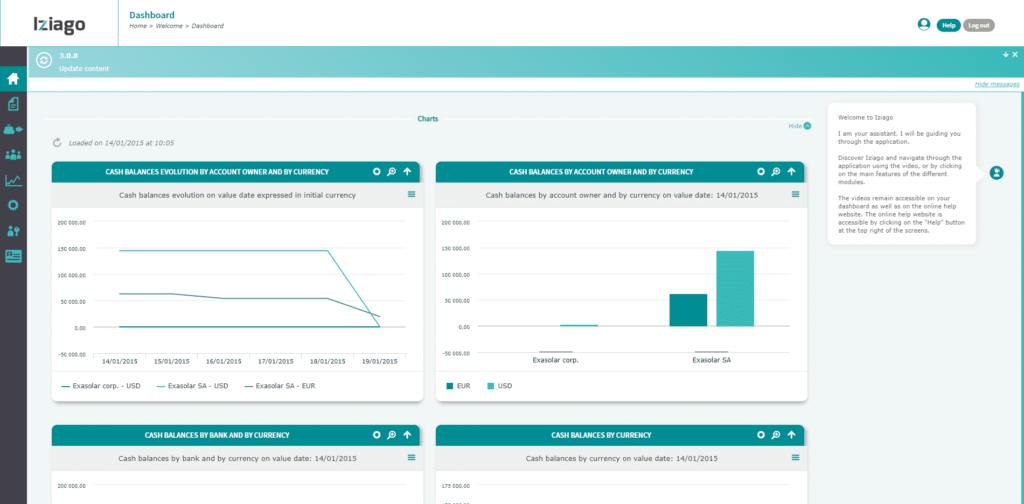

Analyze your account balances'evolution

View your cash management plan immediately (in graphic and table formats)

Our tool uses your saved forecasts toprepare your cash management plan (by day, week or month). You can follow the evolution of the balances of your accounts and groups of accounts. You can visualize your expected cash inflows and outflows. This solution is ideal to know your financial capacity and anticipate an investment, a hiring…

- Access all your information at a glance: the software’s home screen automatically shows charts depicting changes to your balances (by company, by currency). Predicting your liquidity in the future allows you to better anticipate your financing needs or your availabilities for projects.

Check the evolution of your forecast balances from your smartphone with the Iziago Mobile Application.

Create and follow up on your treasury budget

Track your expense and revenue targets

Cegid Iziago allows you to create and modify forecast budgets for your company.

You fill in your company’s expense target (rent, salaries, etc.) and revenue target (sales, contributions, etc.) over the long term and you benefit from an analysis periodicity (weekly, monthly, quarterly, as you wish). You can quickly compare your cumulative cash flows (realized and forecasted) to those in your budget.

- Cegid Iziago gives you a long term vision on your budgets. You can see at a glance the financial situation of your company over a calendar year and you can easily adjust the amounts per budgetary code.

Make the right decisions for your business

Anticipate your cash management needs and distribute your reports

The cash management plancreated shows a forecast with your available funds or your financing needs.

With the tool’s reports, you can analyze your transactions by transaction type and budgetary code.

Analyzing your cash management plan allows you to anticipate changes to cash flows and to take the right management decisions for your company VSE or Small Business (cash transfers, loans, deposits, etc.).

- With our Cash forecasting module, you save time. Spending less time creating reports allows you to focus on your core role:analysis and decision makingfor your business. You can provide your management with the reports generated in PDF format or, asthe number of users is unlimited, you can give your manager access so that they can view the reports whenever they want.

What are the differences with Excel?

Data reliability

With our tool,No more formula and copy and paste errorsor deleted data… frequent occurrences when using Excel.

Longevity of your forecasts and reports

The ease-to-use tool allows all stakeholders in your workforce to work with it. The cash forecasting module gives you the ability to create specific tables and produce individual reports that teams can use and reuse. Le module de prévisions de trésorerie vous offre la possibilité de créer des tableaux spécifiques et produire des reportings individuels que les équipes pourront utiliser et réutiliser.

Fine analysis and graphical display

Analyzing data in Excel can be complex: too much information, no hierarchies, charts created manually, etc. With our tool, you geta readable dashboard and a clear viewof your treasury to analyze your data.

One version for everybody

Our solution is ideal for collaborative work. Where Excel shows its limits when multiple versions of the same Excel file coexist and information is difficult to share, the cash forecasting module offers unlimited access to different users in order to be able to work together on forecasts.

Real-time display

With the cash forecasting module, you can consult your data in real time. Excel does not offer this possibility and does not allow information to be updated automatically.

Accessible anywhere

Unlike an Excel file, specialized software in SaaS mode (Software as a service) can be accessed on the Internet in a secure way wherever you may be, from any computer, tablet or mobile device, on Mac or Windows.

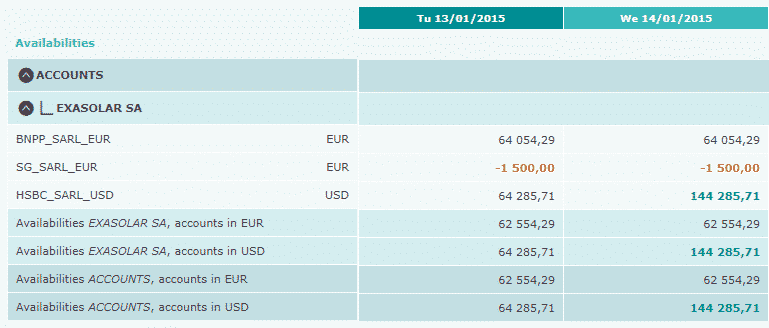

Connect your treasury forecasts with the Automatic account statement retrieval - Europe

With the “Automatic account statement retrieval” option available in our tool, you can retrieve your bank accounts’ balance and movements and synchronize them with your cash forecasting module. You will get a quick reconciliation of your forecasts and a real time adjustment according to your available cash.

Why combine both modules?

- View statements for all your accounts, including accounts in other European countries.

- Save time, our solution centralizes all your accounts, even in different banks, you don’t have to go to each bank’s website to view your account statements.

- Easy to use to view your balances and movements.

- Automatic adjustment of your treasury forecasts according to your balances.

Payments module

The Payments solution allows you to make and track payments worldwide.

Direct debits Module

The Direct Debit solution allows you to collect your customers easily and quickly.

Account statements module

The Account Statement Retrieval tool allows you to view all of your accounts in a single interface.